Cost of Living – Borrowing

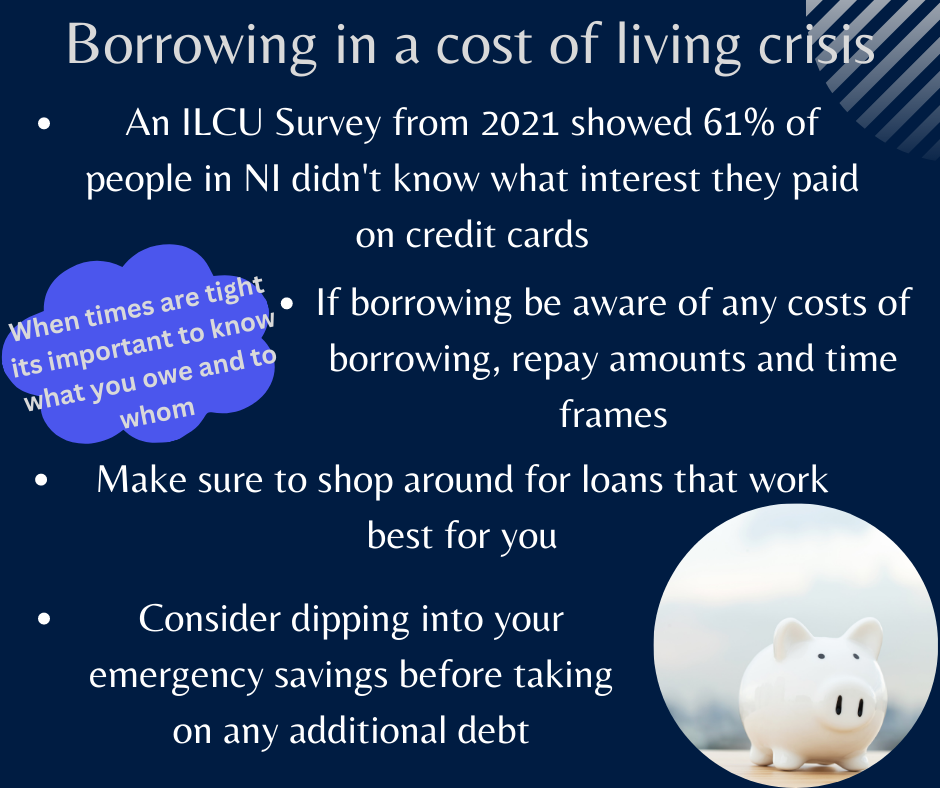

When times are tight, it is very important to be aware of what you owe and who you owe it too. Be very careful with any borrowing that you may be doing at this time. At the start of 2022, the ILCU published a survey where nearly half (48%) of all respondents in Northern Ireland used credit cards to pay for purchases every month 61% of these did not know what interest they paid.

It is very important to be aware of what your repayments are and the cost of all borrowing. Be very wary of high-cost credit, particularly from payday lending. This is often intended to bridge a gap and the interest can be very high! In some cases, you may be repaying more than you borrow.

The Money Advice and Pension Service recommends that this is the perfect time to be using any emergency savings you may have.[1] If you are in a position to borrow, be careful to shop around.

It may be in your best interest to consolidate several debts into one payment via way of a consolidation loan. Many lenders offer these. If this is something you’re considering, be sure to get quotes from several different sources. Lurgan Credit Union may be able to lend to you, subject to loan assessment. You can contact the loans team on 028 38325016, option 2, or apply via our website.

A BBC NI Spotlight investigation has found that food bank users in Northern Ireland are being targeted by paramilitary loan sharks. https://www.bbc.com/news/uk-northern-ireland-63950532

Don’t turn to an illegal moneylender! Don’t let feelings of desperation inform your decision making.

Additionally, please remember if something sounds too good to be true – it almost certainly is. Be scam aware at every turn. The FCA operate Scamsmart (https://www.fca.org.uk/scamsmart), AgeUK has a page about latest scams (https://www.ageuk.org.uk/barnet/our-services/latest-scams/) and Citizens Advice Bureau have a useful website at https://www.citizensadvice.org.uk/consumer/scams/check-if-something-might-be-a-scam/.

If you think you have been targeted by a scammer or an illegal money lender please Don’t hesitate to contact PSNI

[1] Ibid.

This cost of living series aims to help you build your financial confidence. You’ll find insights, tips and suggestion to help you feel more knowledgeable about managing your money, as well as jargon free answers to some basic financial questions. This information can also be found on the Credit Union money on your mind series. The content within this series is aimed to provide general guidance and information only. It does not represent financial advice.