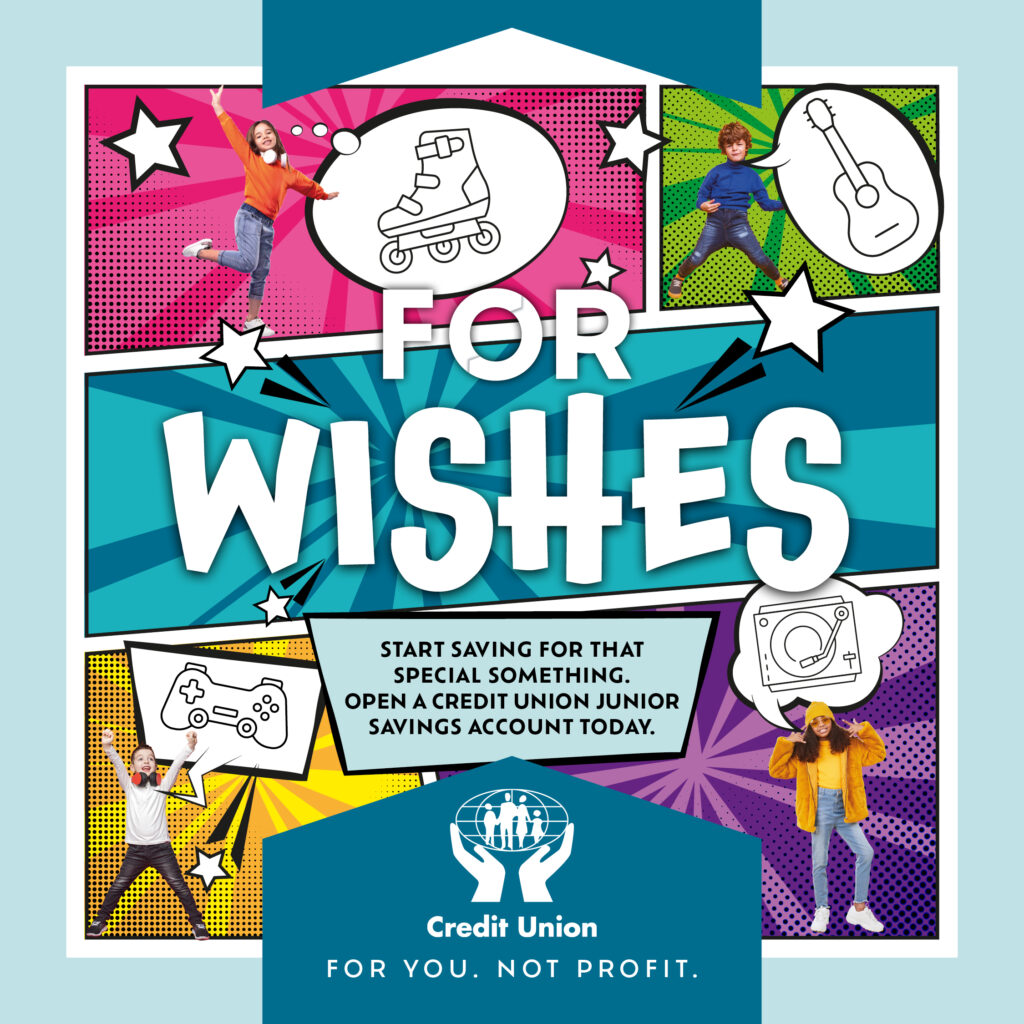

Junior Savers Week 2024

For Wishes: Not Profit

Minor deposit accounts allow children to save regularly from an early age. Children can save up to £10,000 in their credit union account, as little or as much at one time. Deposits can also be paid into the account by direct debit from a bank account or child benefit from the social security agency via the parent or legal guardian’s account.

Minor accounts are for children from birth up to age sixteen. Once the child reaches age sixteen, they can transfer to a main shareholder account in the credit

union.

Top tips for young savers

Welcome to a lifelong relationship with money:

- Get into the habit of budgeting so you can make the most of your time and money.

- When you do spend, save what’s left over. The same goes for extra pocket money. Keep your savings in an account and earn interest in the meantime.

- Small amounts quickly add up no matter how little you save each week.

- Money doesn’t grow on- you know what! Your parents want you to be secure and have it better than they did, but they are not a bottomless well of money! It’s easy to get carried away so try to save as well as spend.

- Be prepared to make choices – you can’t have everything, all of the time!

- Have a spending limit and stick to it. Break down your weekly limit and budget for each day. If you spend too much early in the week, cut back later on.

- Talk to your parents and friends about money.

By discussing what’s involved in paying for holidays, a new TV, car, or even groceries, you find out just how many expenses there are in life, what things cost, what good value is and when you’re being ripped off. This information can help you make healthy financial decisions.

Tips to encourage saving

Play!

- Turn your living room into a shop and put some price tags on every day food items, as well as fun items like toys. Give them a calculator and a set budget that they have to stick to and send them off shopping. This is great way to teach them needs versus wants.

Chore planning.

- Ok, so maybe not the most ‘fun’ thing in the world! If they have new roller skates in mind then sit down with them and write out how many chores/tasks they would need to complete to reach their savings’ goal for the skates. They can track their progress out on a homemade chart for their wall. This will give them a great sense of accomplishment too.

Open a Credit Union account

- For children, saving money in their local credit union helps develop great habits and also teaches them the value of credit unions which are run by the community, for the community.

Our junior savers are the future, and we will always be there for them in the future.

School Savings Scheme

Lurgan Credit Union have collaborated with 11 of our local primary schools to encourage our younger generation to take responsibility for their savings.

In academic year 23/24 the Board of Directors agreed to continue a savings incentive for these schools. For every £1000 the children in a particular school save we will donate £100 to the school to use as they wish. Maximum donation £300. This year we gave £1,200 back to these schools.